In today's fast-paced world, staying ahead in the stock market is crucial for investors aiming to optimize their portfolio returns. Our team of data analysts embarked on a journey to extract valuable insights from the stock market and offer strategic guidance to investors. Leveraging a comprehensive dataset spanning an impressive 138 years, we applied our analytical expertise with tools like Excel, Tableau, and MySQL to uncover hidden trends and patterns.

Objective

Our primary goal is to dive deep into the stock market, offering insights that will assist investors in making informed decisions. By analyzing key performance indicators, valuation metrics, market sentiment, and more, we aim to uncover potential opportunities and risks within the stock market.

Data Description

The "synthetic_stock_data.csv" dataset serves as the foundation for our analysis. It encompasses comprehensive stock market data for select major companies, containing 20 columns and an extensive 50,000 records. This dataset covers a remarkable period from 1886 to 2023, providing a rich historical context for our exploration.

The dataset includes a wide range of financial metrics and indicators, such as stock prices, trading volumes, dividends, moving averages, and technical indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence). Additionally, it offers insights into market volatility, company valuations, market capitalization, and geographical and industry categorizations.

Data Preprocessing

To ensure the data's suitability for analysis, several preprocessing steps were undertaken:

- Null Values: We meticulously checked for and addressed any null values within the dataset to maintain data integrity.

- Unnecessary Columns: Removed unnecessary columns, such as Bollinger Bands (Upper) and Bollinger Bands (Lower), to focus on the most relevant information.

- Date Format: Standardized the date format to YYYY-MM-DD for consistency and compatibility with MySQL.

- Data Manipulation: Performed various data manipulations using tools like Power Query Editor, Excel, Power BI, Tableau, and MySQL to transform the data for analysis.

Tools Used

A diverse set of tools was employed to conduct this comprehensive analysis:

- Microsoft Excel: A versatile spreadsheet software offering data manipulation and visualization capabilities.

- Tableau: A powerful data visualization tool that creates insightful dashboards and charts.

- MySQL: A widely-used relational database management system, ideal for handling large datasets.

- Microsoft Power BI: A business analytics service that enables data transformation and visualization.

Dashboards using Different Tools

Microsoft Excel Dashboard

Power Bi Dashboard

Tableau Dashboard - Click here

Stock Performance Analysis

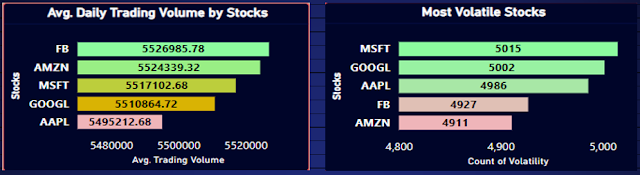

The stock market analysis focused on several key stocks, including tech giants Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Google (GOOGL), and Facebook (FB). Each stock was evaluated across various performance indicators, providing a holistic view of their strengths and potential risks.

Dividend and Valuation Metrics

Dividends play a crucial role in investor returns. Our analysis delved into the dividend history of these stocks, assessing their dividend yield and payout ratios. Additionally, we examined valuation metrics such as Price-to-Earnings (P/E) ratios to identify potential undervalued or overvalued stocks based on investor expectations and growth potential.

Market Capitalization and Price Range

Market capitalization, a key indicator of a company's size and value, was analyzed to provide context to the stocks' performance. We identified stocks with the highest market capitalization and assessed their proximity to 52-week highs and lows, indicating potential buying opportunities and recent performance.

Market Sentiment Indicators

Understanding market sentiment is vital for making timely investment decisions. Our analysis considered indicators like moving averages and RSI to gauge the market's sentiment towards these stocks. We identified stocks with strong buying signals, suggesting potential growth opportunities, and stocks with high selling signals warranting a more cautious approach.

Strategic Recommendations

Based on our comprehensive analysis, we provided strategic recommendations for investors, including:

- Microsoft (MSFT): With its strong buying signals and high market capitalization, we suggest a "buy-and-hold" strategy for consistent returns.

- Apple (AAPL): Given its proximity to its 52-week high and robust buying signal, we recommend considering buying Apple for its strong performance and growth potential.

- Google (GOOGL): Backed by strong buying signals and performance near its 52-week high, Google showcases a solid choice for growth-oriented investors.

- Amazon (AMZN): While Amazon is close to its 52-week low, indicating a potential buying opportunity, we advise a cautious approach due to lower buying signals.

- Facebook (FB): Despite its significant market capitalization and trading volume, Facebook exhibits high selling signals, suggesting a more cautious stance until market sentiment improves.

Conclusion

Our exploratory data analysis of the stock market reveals valuable insights for investors, helping them navigate the complex world of stock investments. By understanding stock performance, valuation metrics, market sentiment, and following our strategic recommendations, investors can make more informed decisions. Stay tuned for more analytical insights as we continue exploring data-driven strategies to unlock potential in the stock market!